Many pet owners credit pet insurance for helping with the cost of lifesaving treatment for their pet. You would as a result expect that most pet owners would have a pet insurance policy. However, this is not the case. The uptake of pet insurance in Australia is comparatively low compared to countries such as the UK, which sits at around 45% of pet owners with pet insurance (source: https://store.mintel.com/report/uk-pet-insurance-market-report).

In Australia, the advancement in veterinary care has led to dramatically improved vet treatments, improved specialist care and much more advanced equipment to assist vets with helping our pets get better. This is great for our beloved pets, however, improvements across the veterinary care industry over the last 10 years has led to an increased cost in treating our pets and many pet owners have been faced with very high vet bills. In some cases, pet owners who didn’t have the funds available were left with the tough choice of having to choose between paying for treatment to help save their dog or cat’s life or opting for euthanasia due to affordability issues. This is a terrible position to be in, which brings us to our first point, the cost of vet bills.

With the high cost of vet care in Australia, it is a wonder why more people in Australia don’t’ have pet insurance. But How much do pet owners spend on their pets?

The cost of vet bills in Australia.

To give you an idea of treatment costs, according to the PetSure Australian Pet Health Monitor 2021, you can expect to pay the following for dogs. On average for allergic skin condition you will pay $713 and the maximum that was paid was $17,720. For ear infections the average was $361 and maximum was $14,629 and Cruciate Ligament Disease was $3,817 and maximum was $26,894. For cats the average for vomiting was $592 and maximum was $10, 784 and hyperthyroidism average was $1069 and maximum was $4,768.

As pet insurance assists with the cost of vet treatment, some pet owners choose to take out a pet insurance policy. However, with the cost of vet care increasing, the cost of pet insurance premiums have risen too. The cost of pet insurance varies depending on policy cover, the area you live in, breed and age of pet etc. As with other insurance, the more comprehensive the level of cover, the more you’ll pay in premium.

The cost of pet insurance also rises as one’s pet ages and many policyholders are paying more for pet insurance when their pets are in their senior years. This is because older pets have more illness related conditions, and the premium is risk adjusted for this.

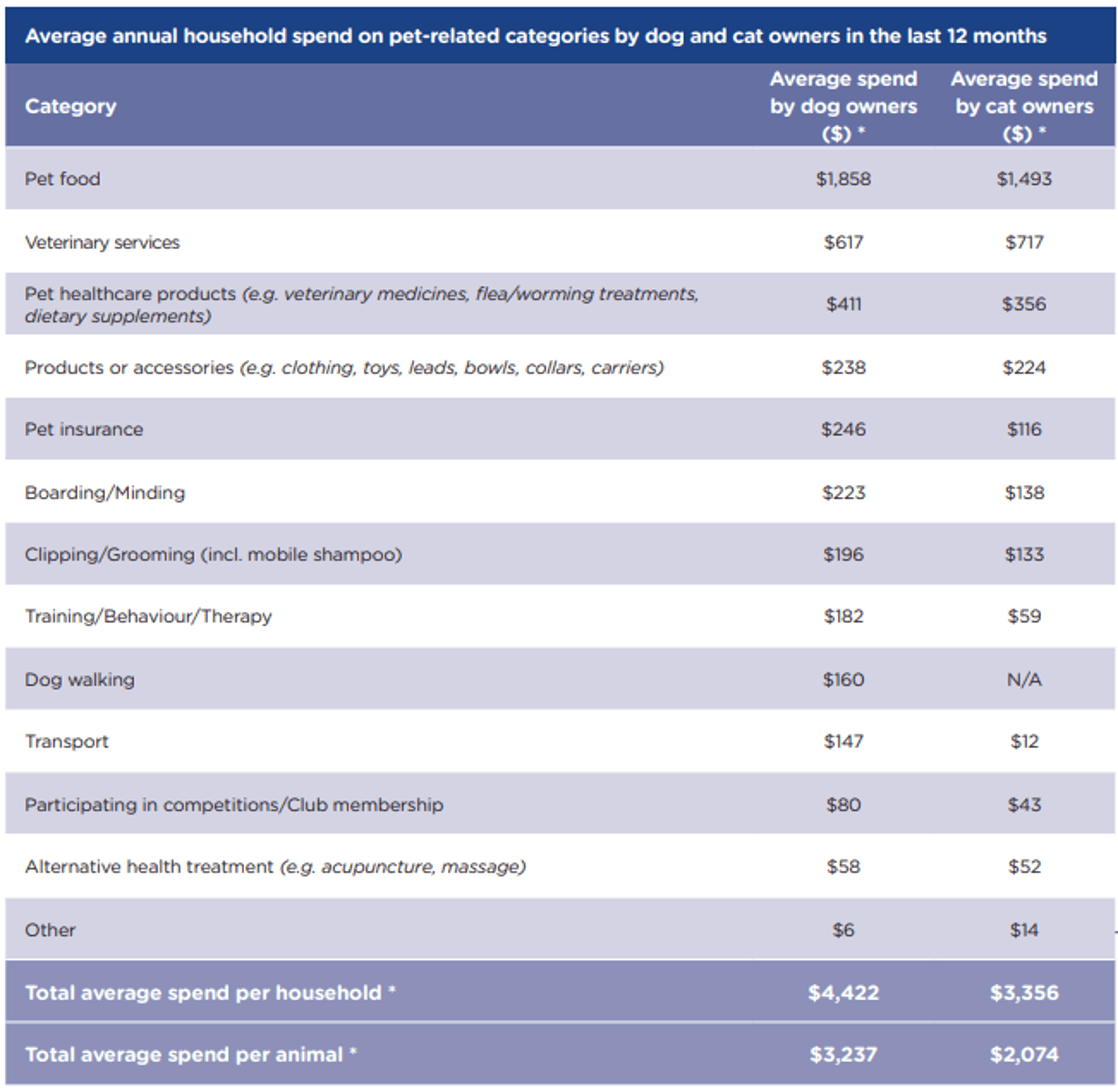

Average annual household spend on pets

How much do pet owners spend on their pets? The Animal Medicines Australia Pets and the Pandemic research publication outlined that pet owners can expect to spend on average $617 to $717 for dogs and cats respectively on vet bills and $411 and $356 on pet healthcare products such as flea and worm treatments respectively. Of the average costs that each household spends on their pet each year, these items ranked as the second and third most expensive costs associated with pet ownership. This is where Potiki steps in. Potiki together with petinsurance.com.au delivers a service and products are aimed at helping our customers with the costs of pet ownership. With pet insurance covering a portion of some of the vet care costs mentioned and Potiki Pet Perks (a non-insurance benefit) providing benefits toward healthcare products such as tick and flea treatments or deworming each year, it is little wonder why this makes sense for pet owners.

Source: Animal Medicines Australia. Pets and the Pandemic – A social research snapshot of pets and people in the COVID-19 era.

Potiki gets pets and believes every pet deserves the best health. Potiki together with Petinsurance.com.au offers pet insurance to cover eligible vet expenses, and as a bonus, Potiki offers extra non-insurance benefits via Potiki Pet Perks which can assist with some of the everyday support and wellness products.

Potiki Perks# comes with the free Potiki Perks app offering exclusive offers, 2-for-1 deals, and up to 20% off in categories like dining, activities, shopping, travel, and more. You will also have access to myPetPass™** which unlocks extra support and savings on everyday pet essentials such as online vet care, discounted pet prescription medication and savings on premium pet food.

Policy coverage

Many pet insurance policies have sub-limits on certain conditions. A sub-limit means that’s the most you will be reimbursed for those particular items, subject to your policy’s overall annual limits (also known as the benefit limit). This is how Potiki together with petinsurance.com.au policies sub-limits operate.

Vet consultation sub-limits: Potiki together with petinsurance.com.au has made every effort to address certain needs in the pet insurance market which is a differentiating factor when considering your pet insurance options. One of the most common complaints about pet insurance is the fact that most policies only offer a limited benefit on vet consultation fees which is likely to be used up quickly each year (most pet insurance policies in the market have a sub-limit of $300 per annum). Potiki (potiki.com.au) together with petinsurance.com.au offer no consultation sub-limit on the Platinum plan. In other words, on the Platinum plan you can claim vet consultations up to the annual benefit limit of $30,000 per annum.

High sub-limits on other conditions; Cruciate Ligament Conditions get a sub-limit of $4,000 per leg per policy period on the Gold Plan and again no sub-limit on the Platinum Plan (up to the annual benefit limit of $30,000 per annum). When you compare this with most other policies in the market, cover averages are between $2,000 and $3,000. Furthermore, this the cover provided by other policies in the market is a applied as a single limit covering both legs. This means that if 2 cruciate ligaments need to be treated in the same policy period at a cost of $4k each for example, the cruciate ligament condition sub-limit will have been reached after one cruciate ligament is treated.

High sub-limits on tick paralysis conditions; Up to $3,000 on the Gold Plan and again no sub-limit on the Platinum Plan (up to the annual benefit limit of $30,000 per annum).

There is also cover on Hip Joint Surgery. Many pet insurance providers don’t include this coverage at all. However, for those that do, many include sub-limits. This again is not the case on the Platinum Plan.

Dental Illness cover: There an optional dental illness cover on the Bronze, Silver and Gold Plans and dental illness cover built into the Platinum plan. This differs from most other policies in the market as the dental illness option is likely only available on the premium or top plans.

Flexibility: With 3 different excess options ($Nil, $250 and $500) for each policy plus a choice of dental illness cover and optional routine care cover (non-insurance benefit), a pet owner can choose a policy and an excess choice that suits their needs.

Claiming:

Ease of claiming: Every policyholder expects a quick and easy claims process which is why one can claim via the pet portal, or have your vet submit it on your behalf via GapOnly®. GapOnly® makes pet insurance claims faster and easier than ever, the GapOnly® service calculates ones claim while you’re still at your vet’s practice, so you only pay the gap (the difference between the total of your vet’s invoice and the claim benefits under their policy).

Claim turnaround times: Excluding the 10-minute GapOnly® turnaround time, 90% of all claims are processed and paid within 5 working days from the point where all documents are available for assessment (Based on Petinsurance.com.au claims data between 2021-2022).

Strength of Underwriter: Potiki together with petinsurance.com.au is backed by Australia’s Leading Pet Insurance Underwriter, Hollard. Hollard has been underwriting pet insurance in Australia for well over a decade.

Please check out:

If you would like to get a quote, please click here